-

×

Tai Jaun – Instagram Hacks University 2.0

2 × $46.00

Tai Jaun – Instagram Hacks University 2.0

2 × $46.00 -

×

Charles Floate – OnPage Mastery

1 × $31.00

Charles Floate – OnPage Mastery

1 × $31.00 -

×

Christina Berkley – The 5K Project

1 × $34.00

Christina Berkley – The 5K Project

1 × $34.00 -

×

Mark Larson – The Complete Guide to Technical Indicators

1 × $39.00

Mark Larson – The Complete Guide to Technical Indicators

1 × $39.00 -

×

Bill Bronchick – Flipping Properties

1 × $57.00

Bill Bronchick – Flipping Properties

1 × $57.00 -

×

Sean Anthony – PDF Profits Protocol

1 × $24.00

Sean Anthony – PDF Profits Protocol

1 × $24.00 -

×

Brent Smith – Bulletproof Banter

1 × $17.00

Brent Smith – Bulletproof Banter

1 × $17.00 -

×

Alexandra Danieli – Selling for Projectors

2 × $39.00

Alexandra Danieli – Selling for Projectors

2 × $39.00 -

×

Ross Jeffries – Speed Seduction: The Final Awakening

1 × $43.00

Ross Jeffries – Speed Seduction: The Final Awakening

1 × $43.00 -

×

Keith Cunningham – Plan or Get Slaughtered

1 × $25.00

Keith Cunningham – Plan or Get Slaughtered

1 × $25.00 -

×

Jermain Linton – Create Unlimited $450 Credit Adwords Accounts and VCCs

1 × $50.00

Jermain Linton – Create Unlimited $450 Credit Adwords Accounts and VCCs

1 × $50.00 -

×

Ben Adkin – The Trial Formula

1 × $27.00

Ben Adkin – The Trial Formula

1 × $27.00 -

×

BowesPublishing – The EVERYTHING Bundle 2024 (KDP)

1 × $9.00

BowesPublishing – The EVERYTHING Bundle 2024 (KDP)

1 × $9.00 -

×

BRYAN KREUZBERGER – BREAKTHROUGH EMAIL

1 × $9.00

BRYAN KREUZBERGER – BREAKTHROUGH EMAIL

1 × $9.00 -

×

Brian & Kam – Trading with Auction Market Theory and Volume Profiles

1 × $10.00

Brian & Kam – Trading with Auction Market Theory and Volume Profiles

1 × $10.00

Buy With Coupon: DLC25 (-25%)

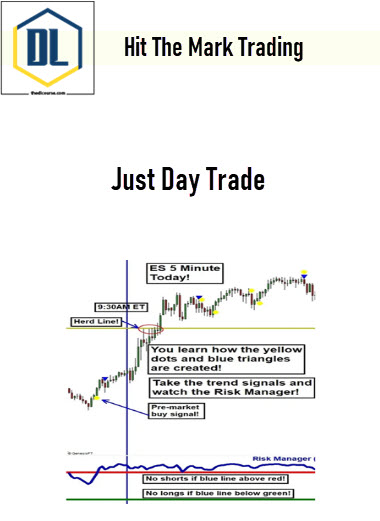

Hit The Mark Trading – Just Day Trade

$975.00 Original price was: $975.00.$30.00Current price is: $30.00.

Delivery: Instant Delivery

SKU: M5N7ZY7B

Categories: Instant Delivery, Trading Stock - Forex

Tags: Hit The Mark Trading, Just Day Trade

Description

Hit The Mark Trading – Just Day Trade

This course is a total intensive immersion program focusing on price trend and momentum for the toughest form trading. You learn high probability trade set-ups including specific entry, protective stop placement, and suggestions for trailing protective stop applicable FOR ALL INSTRUMENTS. Keep your trading mechanical…spot the set-ups, follow the rules, enter the trades with important stop loss. Trust the mechanical system, which includes a trailing stop. We also have profit-taking stations the Herd uses.

Why serve as a slave to gurus and tip sheets when you can invest your time in education learning to call the trades yourself? I created Hit the Mark Trading based on everything I wish I would have known when I first started trading. I am honored you are considering working with me. We are visual traders using price action and indicators with an eye on fundamentals holding risk control paramount. Following “the herd” is our goal using trend, momentum, and understanding nothing in trading is random.

What You’ll Learn In Just Day Trade

We follow the pros, who create the volume. We know THEIR common benchmarks for breakout and reversal. You are taught trend and counter trend trading. You are taught their Bread and Butter set-up! Get ready to follow the professional herd, remembering safety in numbers!

More courses from the same author: Hit The Mark Trading

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TheDLCourse account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TheDLCourse account then going to Downloads Page.

Related products

-97%

-48%

-96%

-53%

-98%

-96%

-95%

-96%