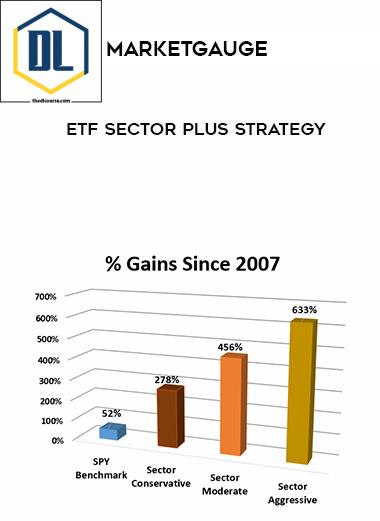

MarketGauge – ETF Sector Plus Strategy

$1,950.00 Original price was: $1,950.00.$109.00Current price is: $109.00.

Product Delivery: Instant Deliver

MarketGauge – ETF Sector Plus Strategy

Trade ETF Sector Trends Like A Pro To Build Your Wealth and Income. Regardless of The General Market Trend!

The Automated ETF Sector Plus System Provides Amazing Returns In Just Minutes Per Week

Traders of any ability can profit from the ETF Sector Plus Strategy by spending only a few hours a week to execute trades because…

- The trading model calculates exact entry and exits for trades so there is NO analysis required.

- All trade alerts are issued at the end of the day so you can literally set up your orders before the market opens.

- The model portfolio never holds more than three positions so there is very little management required.

Why The 2015 Pullback In The Models’ Equity Curves Is A BIG Opportunity Now!

We’re not going to try to hide the fact that 2015 was a rough year for the ETF Sector models, but the reasons behind it are over and very unusual, here’s why…

The majority of the negative performance in 2015 stems from the 3-day crash from August 19 to August 24th. In fact, on 8/19, right before the S&P’s historic 3-day slide our Moderate model was up about 1% for the year and in line with the market’s performance.

Unfortunately our sell signals occurred on 8/21. This means we exit long positions the next day which was the extraordinary gap on the 24th. This led to unusually bad exits.

The extreme gap also caused the model to switch into a short position at this same extreme level, and the next couple months this was also stopped out at a loss.

In prior “quick” corrections the model was positioned short prior to the bulk of the selloff or it had defensive positions such as bonds or gold so it was not hurt as much.

In conclusion, the model is designed to take advantage of declines that last longer than 3 crash days, and if the market had continued lower the model would have done quite well. Additionally, had the crash happened one day later, the models’ losses would be half of what they currently show.

As a result, of the 2015 and early 2016 sell off the models began a new cycle of Sector leadership, and 2016 has been one of the best years for the model and the year is long from over!

Its historic performance up to 2015 demonstrates that in any decent trend up or down it can easily and dramatically outperform the general market over time.

The trade alerts could not be easier. Here is what a typical trade alert will look like:

“ETF Sector Plus Strategy Trade Alert: Buy GDX at the market on the open Monday 2/1/2016”

Readmore about: MarketGauge

Related products

Instant Delivery

Instant Delivery

Instant Delivery

Instant Delivery

Instant Delivery

Drniki – Find Alpha Course – How to Find New Crypto Projects

Instant Delivery

Instant Delivery

Trading Stock - Forex