-

×

![William Bronchick – The Legalwiz Guide to Buying Properties Subject To [Real Estate]](https://www.thedlcourse.com/wp-content/uploads/2020/06/William-Bronchick-–-The-Legalwiz-Guide-to-Buying-Properties-Subject-To-Real-Estate].jpg) William Bronchick – The Legalwiz Guide to Buying Properties Subject To [Real Estate]

1 × $47.00

William Bronchick – The Legalwiz Guide to Buying Properties Subject To [Real Estate]

1 × $47.00 -

×

Stephen Garner – Video For Real Estate Agents

1 × $29.00

Stephen Garner – Video For Real Estate Agents

1 × $29.00 -

×

RROP – Low Timeframe Supply & Demand

1 × $9.00

RROP – Low Timeframe Supply & Demand

1 × $9.00 -

×

MIT – Master Design Thinking

1 × $30.00

MIT – Master Design Thinking

1 × $30.00 -

×

Regan Hillyer – 7 Days To A Kick Ass New You

1 × $122.00

Regan Hillyer – 7 Days To A Kick Ass New You

1 × $122.00 -

×

Just for Traders – Options Buying Course

1 × $9.00

Just for Traders – Options Buying Course

1 × $9.00 -

×

ZEUSSY Mentorship 2024

2 × $9.00

ZEUSSY Mentorship 2024

2 × $9.00 -

×

W.D. Gann – Best Trading Systems

1 × $9.00

W.D. Gann – Best Trading Systems

1 × $9.00 -

×

Jason Henderson – “Email Response Warrior + Email Inbox Warrior”

1 × $9.00

Jason Henderson – “Email Response Warrior + Email Inbox Warrior”

1 × $9.00 -

×

Jenna kutcher – 20 Essential Email Responses for Wedding Photographers

1 × $19.00

Jenna kutcher – 20 Essential Email Responses for Wedding Photographers

1 × $19.00 -

×

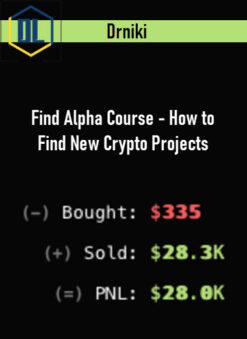

Drniki – Find Alpha Course – How to Find New Crypto Projects

1 × $70.00

Drniki – Find Alpha Course – How to Find New Crypto Projects

1 × $70.00

Buy With Coupon: DLC25 (-25%)

Master Trader – How to Swing Trade Call and Put Options

$27.00 Original price was: $27.00.$11.00Current price is: $11.00.

Delivery: Instant Delivery

SKU: M6U7CROT

Categories: Instant Delivery, Trading Stock - Forex

Tags: How to Swing Trade Call and Put Options, Master Trader

Description

Master Trader – How to Swing Trade Call and Put Options

Learn swing trading options strategies substituting a call option for a long stock position or a put option for a short stock position with price patterns

In this short course, we will describe and review using calls and puts with price patterns based on Master Trader Swing Trading Strategies.

This session will bring clarity to what confuses the majorities.

Swing trading stocks and options has a holding period of 2 – 10 days and is designed to generate income from capturing the bulk of the high-probability setups on daily charts.

Buying options requires significantly less capital than trading stocks, and can generate a terrific return on capital.

However, it requires the knowledge of price patterns based on Master Trader Technical Strategies for Swing Trading and the right Options to use.

What You’ll Learn In How to Swing Trade Call and Put Options

- Master Trader’s main chart patterns we use for swing trading stocks and options

- Master Trader’s approach in swing trading options and picking the right strike price and expiration date

- How to avoid the typical errors of novice option traders, and how to stack the odds in your favor

- How trading using Master Trader Strategies will dramatically increase your odds of success

- How we scan for new opportunities in real-time

More courses from the same author: Master Trader

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TheDLCourse account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TheDLCourse account then going to Downloads Page.

Related products

-97%

-30%

-99%

-96%

-96%

-96%

-59%

-99%