-

×

Jon Benson – VSL Fast Track 2018

1 × $48.00

Jon Benson – VSL Fast Track 2018

1 × $48.00 -

×

Scott Jack – Magnetic Interaction

1 × $15.00

Scott Jack – Magnetic Interaction

1 × $15.00 -

×

Ross Jeffries – Speed Seduction: The Final Awakening

1 × $43.00

Ross Jeffries – Speed Seduction: The Final Awakening

1 × $43.00 -

×

Andrew Tate – Body Language

1 × $10.00

Andrew Tate – Body Language

1 × $10.00 -

×

Ty Cohen – Kindle Cash Flow University 2.0

2 × $9.00

Ty Cohen – Kindle Cash Flow University 2.0

2 × $9.00 -

×

Sean Longden – Agency Blueprint

1 × $65.00

Sean Longden – Agency Blueprint

1 × $65.00 -

×

Product University – Unique Amazon Strategy

1 × $92.00

Product University – Unique Amazon Strategy

1 × $92.00 -

×

Mark Larson – The Complete Guide to Technical Indicators

2 × $39.00

Mark Larson – The Complete Guide to Technical Indicators

2 × $39.00 -

×

Digital Income Project – Content MBA

1 × $33.00

Digital Income Project – Content MBA

1 × $33.00 -

×

Tirzah Firestone – Wounds Into Wisdom

1 × $114.00

Tirzah Firestone – Wounds Into Wisdom

1 × $114.00 -

×

Tom Torero, Jon Matrix & Yad – Daygame.com: Date Against The Machine

2 × $10.00

Tom Torero, Jon Matrix & Yad – Daygame.com: Date Against The Machine

2 × $10.00 -

×

Steven Pieper – Author Marketing Mastery Through Optimization 4

1 × $9.00

Steven Pieper – Author Marketing Mastery Through Optimization 4

1 × $9.00 -

×

Adrian Salisbury – Ecamm Live Academy

1 × $9.00

Adrian Salisbury – Ecamm Live Academy

1 × $9.00 -

×

Francis Nayan – The Freedom Email Freelancer Holiday Bundle

1 × $89.00

Francis Nayan – The Freedom Email Freelancer Holiday Bundle

1 × $89.00 -

×

MIT – Master Design Thinking

1 × $30.00

MIT – Master Design Thinking

1 × $30.00 -

×

60 Years of challenge – Magic Mindsets & Handshake Demonstration

1 × $25.00

60 Years of challenge – Magic Mindsets & Handshake Demonstration

1 × $25.00 -

×

Alex Becker – Elysium First

1 × $23.00

Alex Becker – Elysium First

1 × $23.00 -

×

Andrew Mioch – Lasting System

1 × $273.00

Andrew Mioch – Lasting System

1 × $273.00 -

×

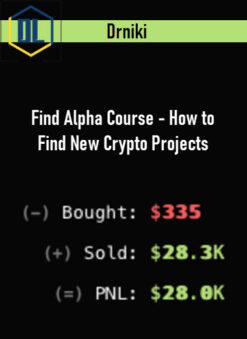

Drniki – Find Alpha Course – How to Find New Crypto Projects

1 × $70.00

Drniki – Find Alpha Course – How to Find New Crypto Projects

1 × $70.00 -

×

Bob Burns – The Swan Speaks

1 × $17.00

Bob Burns – The Swan Speaks

1 × $17.00 -

×

Photo Reading Deluxe Course

1 × $67.00

Photo Reading Deluxe Course

1 × $67.00 -

×

Lorell Lane – Social Sales Lab

1 × $9.00

Lorell Lane – Social Sales Lab

1 × $9.00 -

×

Liana Ling – Bullet Proof Meta (Facebook) Ads

1 × $9.00

Liana Ling – Bullet Proof Meta (Facebook) Ads

1 × $9.00 -

×

Dave Kaminski – Facebook Ads For Regular People

1 × $49.00

Dave Kaminski – Facebook Ads For Regular People

1 × $49.00 -

×

Jason Capital – Power Influence System

1 × $31.00

Jason Capital – Power Influence System

1 × $31.00 -

×

Simpler Options – Ultimate Options Trading Blueprint

1 × $19.00

Simpler Options – Ultimate Options Trading Blueprint

1 × $19.00 -

×

David Snyder – Defense Against The Dark Arts

1 × $47.00

David Snyder – Defense Against The Dark Arts

1 × $47.00 -

×

Zac Hansen – The Productized Community

1 × $29.00

Zac Hansen – The Productized Community

1 × $29.00 -

×

Quantifiable Edges Bundle

1 × $45.00

Quantifiable Edges Bundle

1 × $45.00 -

×

Dan Kennedy - Copywriting Mastery and Sales Thinking Boot Camp

1 × $75.00

Dan Kennedy - Copywriting Mastery and Sales Thinking Boot Camp

1 × $75.00 -

×

Roger And Barry - Extractafy

1 × $15.00

Roger And Barry - Extractafy

1 × $15.00 -

×

BeSomebodyFX – The Real Fundamental Analysis

1 × $11.00

BeSomebodyFX – The Real Fundamental Analysis

1 × $11.00

Buy With Coupon: DLC25 (-25%)

W.D. Gann – Geometric Angles Applied To Modern Markets

$399.00 Original price was: $399.00.$59.00Current price is: $59.00.

Delivery: Instant Delivery

SKU: LSYCCJEL

Categories: Instant Delivery, Trading Stock - Forex

Tags: Geometric Angles Applied To Modern Markets, W.D.Gann

Description

W.D. Gann – Geometric Angles Applied To Modern Markets

Learn How To Properly Scale Your Charts For Successful Trading

W.D. Gann’s “Geometric Angles”

W.D. Gann was a famous stock trader and financial analyst who used geometric angles in his technical analysis. According to Gann, angles represent the relationship between time and price in the stock market. He believed that specific angles could be used to predict future trends and price movements. Gann used various tools such as a protractor, ruler, and square to create his angles.

He also believed that the angles could be used to identify key levels of support and resistance. However, the use of geometric angles in stock market analysis is highly controversial and many traders have different interpretations of Gann’s methods. Nevertheless, his theories and techniques continue to be studied and applied by traders and analysts in the financial industry.

What You’ll Learn In Geometric Angles Applied To Modern Markets?

Lesson #1 (60 minute private session):

- W.D. Gann’s Introduction to Geometric Angles.

- Importance of the square in nature.

- Using the square to divide time and price proportionately.

- Important angles within the square.

- Common scaling problems.

- How to scale charts for all markets and timeframes.

Lesson #2(60 minute private session):

- What is a timekeeper?

- Using timekeepers to scale charts for all timeframes.

- Solving geometric angles for all markets and timeframes.

- Squaring highs and lows using geometric angles.

- Understanding and interpreting price action around geometric angles.

Lesson #3(60 minute private session):

- W.D. Gann’s Mechanical Method as it applies to geometric angles.

- Buying and selling points.

- Analyzing the market using geometric angles.

- Building an entry using geometric angles.

- Trade management.

Lesson #4(60 minute private session):

- Analyzing live market conditions using geometric angles (live trading session).

- Top down analysis of any market you choose.

- Identifying sections of the market.

- Understanding possible market scenarios.

- Speculating the next highest probability move in the market.

More courses from the same author: W.D. Gann

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TheDLCourse account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TheDLCourse account then going to Downloads Page.

Related products

-40%

-98%

-88%

-95%

-97%

-30%

-96%

-99%